aurora co sales tax license

Colorado state salesuse tax. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Licensing a company to conduct business in Aurora begins with the Business License Application.

. An Aurora Colorado Tax Registration can only be obtained through an authorized government agency. Sales taxes are based on the vehicle purchase price. In lieu of recording a Adams County trade company name our filing service fee includes trade name registration and newspaper legal publication for 4 weeks you can also form a License in CO or form an CO License starts 49 plus state fee for most states includes bylaws for the License and Limited Liability operating agreement for the License that is required to open a.

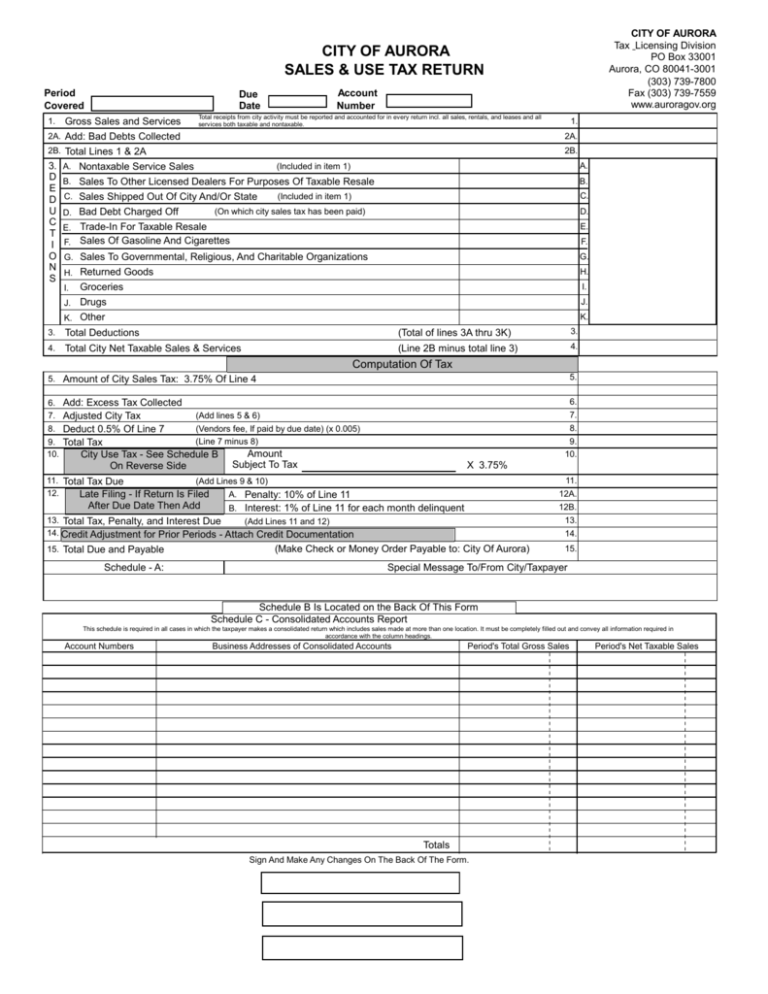

The Aurora sales tax rate is 375. The Colorado sales tax rate is currently 29. Arvada CO Sales Tax Rate.

2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. 1800 Harlan Street Suite C Edgewater CO 80214. Aurora-RTD 290 100 010 025 375.

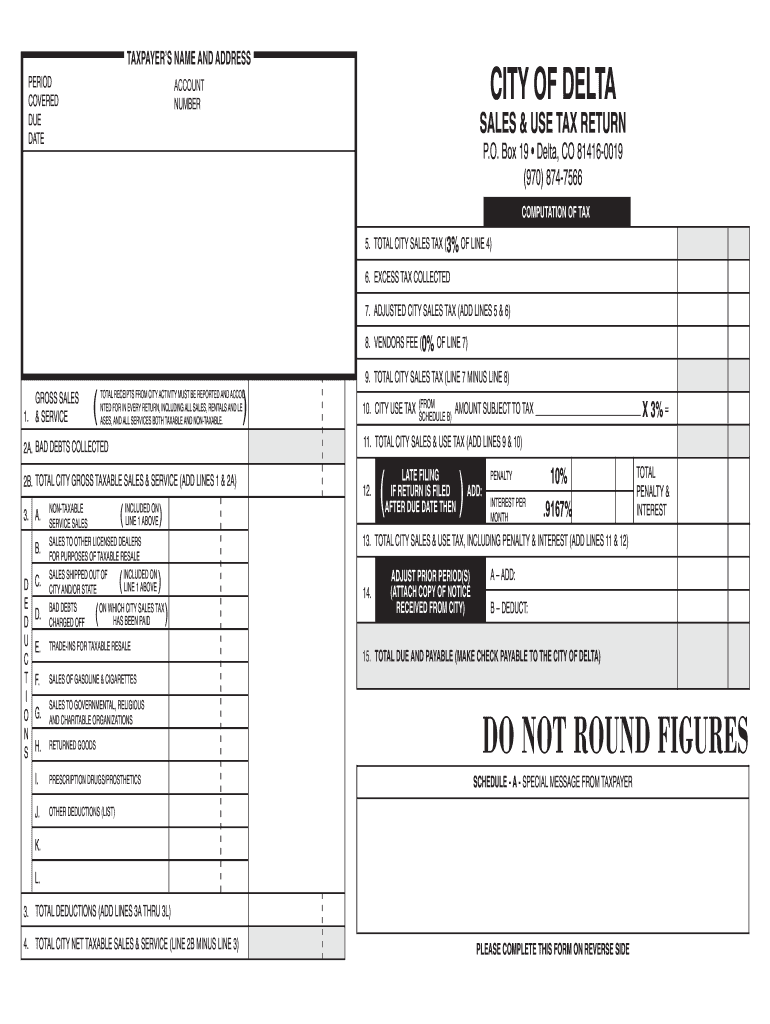

City of Aurora 250. Alameda parkway suite 5700 aurora co 80012 3037397057 email protected You must obtain a sales and use tax license in order to conduct business in the city of delta. Commerce City CO Sales Tax Rate.

Did South Dakota v. Annual - Taxes due of 100 or less per year. The minimum combined 2022 sales tax rate for Aurora Colorado is 8.

Mailing Payment Address PO. Aurora CO Sales Tax Rate. Brighton CO Sales Tax Rate.

Sales taxes are due one time after a new or used vehicle purchase at the time your vehicle is titles. Sales. Reporting Frequency is subject to change by the Finance Director.

This calculator is for new registrations only. Monday - Friday 8 am. Centennial CO Sales Tax Rate.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get an Aurora Colorado Tax Registration. Because of the different cities and taxing jurisdictions within Adams County the sales tax rates will vary. 15151 E Alameda Pkwy 1600 N Florence St 2125 S Kittredge Way Note please use street prefixes E N or S without punctuationOnly addresses.

Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month. In 2003 the electors of Arapahoe County voted to approve a resolution imposing a 025 County Open Space Sales and Use Tax on the sale of tangible personal property at retail and the furnishings of certain services within the County. Monthly - Taxes due of 60 or more per month Quarterly - Taxes due of 59 or less per month.

For a temporary location other than your regular business location and valid for one event only where there are three or more vendors. The City of Auroras tax rate is 8850 and is broken down as follows. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get an Aurora Colorado Sales Tax Permit.

The annual sales and use tax license fee is 1000 and must accompany a completed sales and use tax license application. City of Aurora Tax Licensing Division staff will help answer questions specific to your industry or business. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

What is the sales tax rate in Aurora Colorado. The County sales tax rate is 025. Report Tax Evasion.

Please do not send your state county or special district payments or returns to the City of Edgewater. Understand the process of obtaining a business license in Aurora taxpayer rights and responsibilities taxes you may have to pay including Sales Tax Use Tax and Occupational Privilege Tax and the reason that audits are conducted. Castle Rock CO Sales Tax Rate.

The resulting business license is the companys authorization to conduct business in Aurora. Single Special Event License. This is a two-year license which is free to all standard sales tax license holders.

15151 East Alameda Parkway - Aurora Colorado 80012 Phone. Colorado Springs CO Sales Tax Rate. This tax is equal to 25 cents on every 100 spent.

Please send a copy of your sales tax return along with your payment for city sales and use taxes to City of Edgewater. Broomfield CO Sales Tax Rate. I declare under penalty of perjury that this application has been examined by me and the statements made.

X To trigger the address pick list start typing like the below examples then select the desired address from the pick list. Box 5602 Denver CO 80217-5602. Boulder CO Sales Tax Rate.

Responsibilities and Objectives of the Open Space Program. This is the total of state county and city sales tax rates. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL.

Excise. Gross sales and service total receipts from city activity must be reported and accounted for in every return including all sales. They should be remitted to the State of Colorado.

Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. 29 RTD salesuse tax. It also establishes the required sales use Occupational Privilege OPT andor Lodgers tax filing roles and allows the business access to a variety of city services including online.

An Aurora Colorado Sales Tax Permit can only be obtained through an authorized government agency. The sales tax license enables the business to collect sales tax when they resell the items.

Post Image For What Is A Sales And Use Tax Permit Permit Tax Storage Auctions

Printable Illinois Sales Tax Exemption Certificates

Set Up Automated Sales Tax Center

How To Register For A Sales Tax Permit In Colorado Taxjar

Illinois Used Car Taxes And Fees

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Should You Be Charging Sales Tax On Your Online Store Small Business Finance Business Tax Tax

Renew Your Sales Tax License Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

How Colorado Taxes Work Auto Dealers Dealr Tax

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Should You Be Charging Sales Tax On Your Online Store Small Business Finance Business Tax Tax

Sales Tax Rates Douglas County Government

Co Sales Use Tax Return Fill Out Tax Template Online Us Legal Forms